Do you need a personal loan? Am One is a US company founded in 1999, and it offers borrowers a chance to apply for a personal loan online. Their goal is to help people quickly locate the perfect lender for their needs.

According to Am One reviews, this platform has helped many borrowers find a personal loan over the years. To find out if it is a suitable option for your situation, we invite you to read so you can make a well-informed decision.

In this review, we’ll go over the company’s offerings and cover things like:

- Essential terms of personal loans at Am One

- How to apply for a loan via Am One’s website

- Am One’s pros and cons

After reading our Am One loan review, you’ll have all the info you need to decide if this service is the best fit for you.

What You Need to Know About Am One Personal Loans

Am One offers a free service on their website that lets you find a personal loan provider anywhere in the US. Once you enter the required information, the lenders whose criteria you meet will appear on the list. You can also get an offer by phone if you prefer.

Next, in our Am One application process review, we’ll go over the platform’s terms and features.

- Expected loan amount

You can apply for a loan ranging from $1,000 to $50,000.

- Annual percentage rate (APR)

This is the lender’s interest rate and can be between 4.99% and 35.99%.

- Monthly payment

This sum depends on the lender and the amount you’re looking to get.

- Loan term

As with monthly payments, the lender sets the loan term. It’s in the range of two to seven years.

- Fees and penalties

Origination fees are usually somewhere between 0% and 8%.

- Types of interests

Most Am One interest rates are fixed and depend on things like your credit score, your annual pre-tax income, possible credit debt, and how much money you need. Some lenders on the platform offer variable interest rates.

- Unsecured or secured loans

With Am One, you can get both secured personal loans and unsecured personal loans. With a secured loan, you have to provide something as collateral—a savings account, a vehicle, etc. There’s no such requirement with unsecured personal loans.

- Arbitration

A separate debt negotiation company handles arbitration. It will help you find a compromise between you and your creditors, such as a reduced monthly payment.

- Prepayment penalty

This type of penalty occurs if you repay your loan earlier than agreed. It can amount to a percentage of the loan or several months of interest.

- Typical approval time

This varies from lender to lender but is usually fast.

- Typical funding time

Once you get approved, you’ll receive your funds in about a day.

What Is Am One’s Personal Loan Eligibility Criteria?

If you are looking to apply for a loan, you have to meet some eligibility criteria. We’ve compiled all Am One loan requirements below:

- Age

You have to be at least 18 years old.

- Citizenship

To get a loan through Am One, you have to be a US citizen or permanent resident.

- Minimum credit score

There’s no minimum credit score, although each loan provider has a unique set of rules. Some lenders accept only the most qualified candidates, while others serve customers with bad credit. One thing is for sure—a higher credit score will get you better terms.

At Am One, there are five credit score groups per Experian’s scale, but some peer-to-peer lenders have as many as 30 categories.

- Income threshold

There is no minimum income requirement.

- Minimum length of credit history

Long credit history can only help. But there’s no minimum requirement on Am One.

How to Apply for a Personal Loan with Am One?

Now that you know all the personal loan details and criteria let’s explore the steps of Am One’s application process (screenshots included). The whole thing takes just a few minutes.

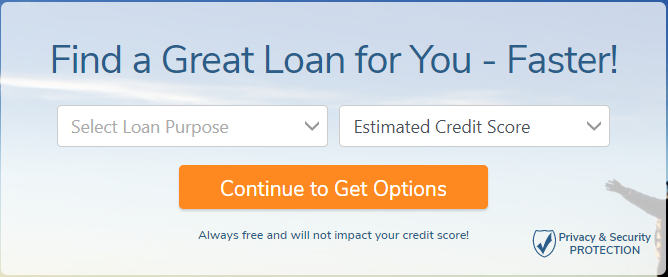

- First, you have to log into your account at www.amone.com.

- Then you’ll see a window in the middle of the screen where you need to enter the purpose of the loan and your estimated credit score.

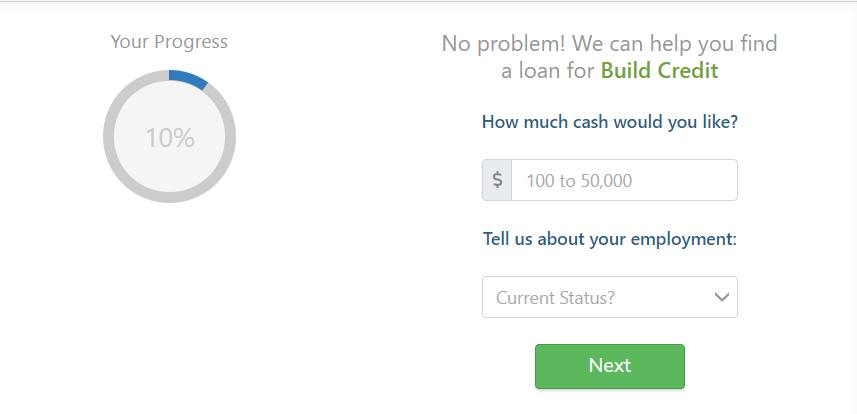

3. In the next step, you need to choose the loan amount and select your employment status from the drop-down menu.

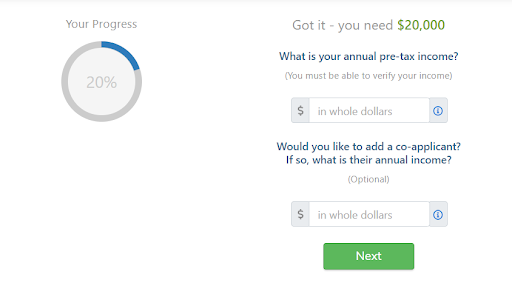

4. Then, you have to enter your annual pre-tax income. In case there’s a co-applicant, you need to enter their income as well.

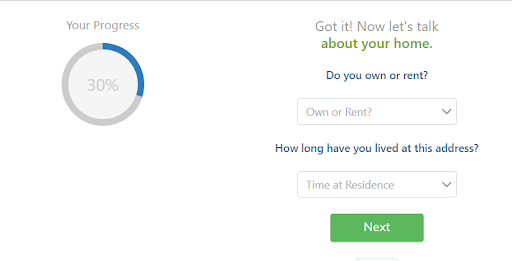

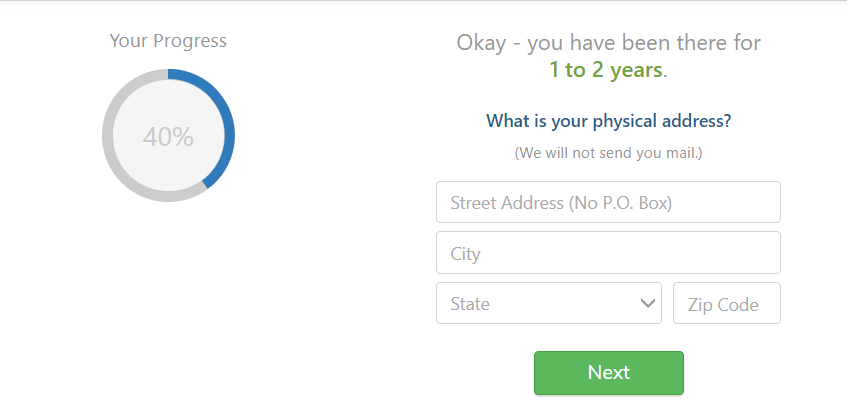

5. Next, you have to say whether you pay rent or have your own place, and how long you’ve lived there.

6. The next page asks you to enter your street address, city, state, and zip code.

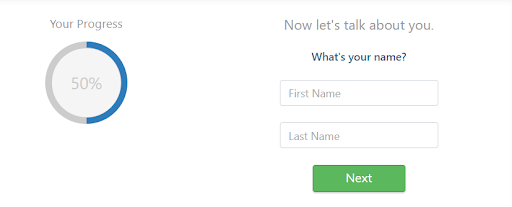

7. Once you’ve filled in your address, you need to give your first and last name.

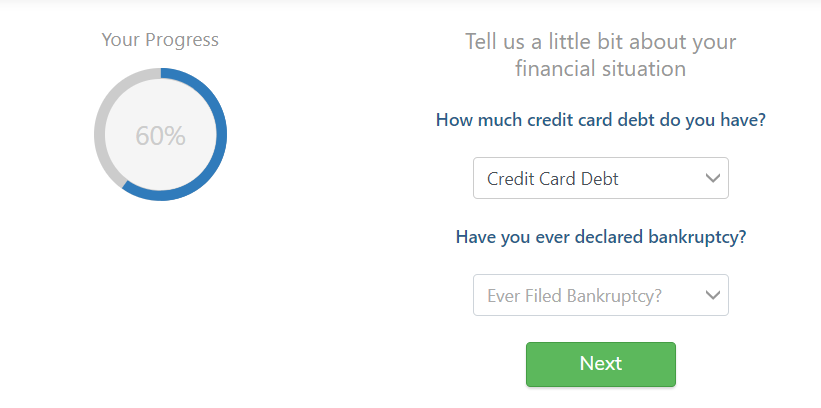

8. Next, you have to specify your credit card debt (if you have any) and whether you’ve ever declared bankruptcy.

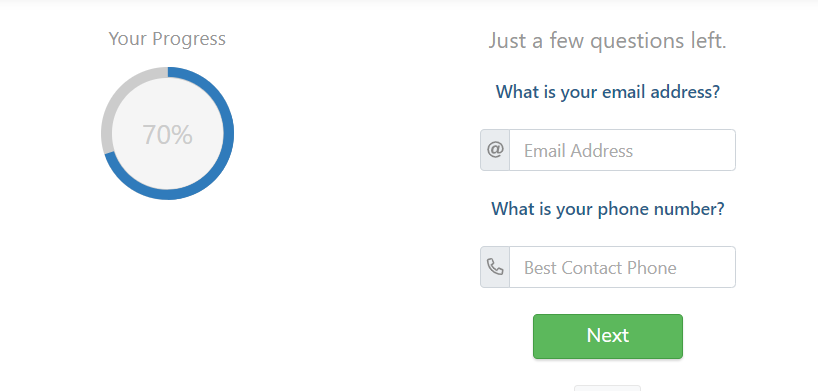

9. Once you’ve provided your financial details, you have to enter your email address and mobile phone number.

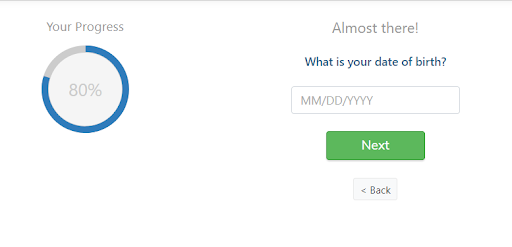

10. Am One then asks you about your date of birth.

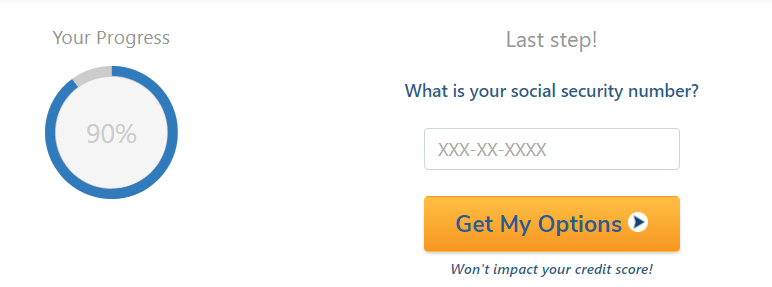

11. The last thing you need to share is your social security number. By clicking “Get My Options,” you accept the company’s disclosures, credit authorization, and consumer pricing information.

12. After you’ve completed the application process, Am One will match you with potential lenders. You can then go through the pre-approval process with your lender of choice.

Alternatives

Am One vs E-Loan

If you want to explore alternatives to Am One, you might want to check out E-Loan. This company has been operating since 1996. It offers a wide range of loan amounts and has excellent customer support.

Am One vs LendingTree

LendingTree has been operating longer than Am One, since 1996, if that’s something that is a factor for you, then you can explore their offers. Also, they have a lower annual percentage rate starting from 3,99%.

Privacy & Security Policy

Am One uses encryption to secure customers’ personal information, and it doesn’t store their personal data. But keep in mind that this company is a part of a larger organization called QuinStreet, which shares data among its businesses to improve their services.

In Conclusion

We hope you found all the information you need in our legit Am One review. The company has been operating for a long time, and its success speaks for itself. The many positive Am One reviews also attest to that.

The platform’s quick application process, educational resources, and the option to avoid collateral are just some of this service’s advantages.

FAQ

- Can I refinance my personal loan?

It’s up to you whether you’d like to use a personal loan acquired through Am One to refinance an existing loan. Refinancing means that you obtain a new loan with better terms, which you then use to pay off the older debt that’s more expensive, thus reducing the amount you owe.

2. What can I use Am One personal loan for?

With the help of Am One, you can obtain a loan for many purposes. The most common reason for getting one is starting a new business, making a large purchase, paying off student debt, unexpected expenses, etc. Anyone who needs to consolidate their debt can use their service as well.

3. Can I get a personal loan online?

You can apply for a personal loan through Am One’s online application form and get approved online too. Once you’re approved, the lender will transfer you the money in one workday. It’s a very simple process.

But keep in mind that some personal loan providers might want to check your credit history before accepting your application (with your permission, of course). Also, only people living in the US can apply for a loan through Am One.

4. Who is Am One personal loan best for?

A personal loan through Am One is best for people who need quick and easy access to credit for handling unforeseen expenses. There is no minimum credit score requirement, so anyone who meets the eligibility criteria can apply, although the higher your score, the better terms you get. To find out more about the minimum standards, check out our Am One loan review above.

5. What is the Am One BBB rating? Is it accredited?

Yes, Am One has BBB accreditation and an A+ rating, meaning the company is trustworthy.