The water heater broke? The coffee machine too? How the heck are you going to start your day?!

This article will reveal one handy, practical, and 100% professional company that deals with such problems. My First American Home Warranty review will go over the services this company offers, its pricing, promptness, what it covers or doesn’t cover, etc. We’ll also cover First American Warranty customer reviews to get an idea of how satisfied existing clients are.

Before we start, let’s warm up with a cup of history.

First American Home Warranty Bio and History

Ever heard of First American Corporation? First American Home Warranty is a subdivision of that company.

First American Corporation was established 131 years ago.

With this in mind, now you have a subdivision (First American Home Warranty) founded on American soil 36 years ago (started in 1984).

Impressive, I know.

I think you had enough history for 1 minute.

Let’s get back to the present and find out more about First American Home Warranty.

What is it?

First American Home Warranty is the leader among homeowner protectors and warranty providers. They offer their services to home buyers, sellers, and homeowners too.

With 36 years of experience in their toolbox and three offices spread throughout the USA, they count as one of the most experienced home service providers on the market today.

Who’s behind it?

Behind this impressive and experienced home warranty provider is the man himself, Jeff Powell.

FAHW State Availability

FAHW is available in 35 states nationwide (as seen in the picture below).

The orange color on the map shows FAHW’s state availability

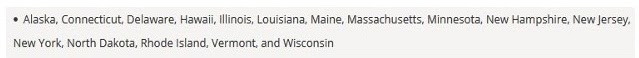

However, here’s a list of the states that don’t cut out the FAHW home warranty coverage list:

What does it do?

FAHW is a renewable annual home provider service covering repairs and replacements of home systems and appliance breakdowns.

In other words, this kind of home warranty coverage steps in to assist with sudden home repairs or other related costs due to an unexpected failure.

Awards and recognitions

You can’t expect 36 years of work to pass unnoticed.

Nor can you ignore more than 590,000 customers served and more than 850 associates employed in its three major offices.

Therefore, let’s see some of First American Home Warranty’s Shiney awards and recognitions:

- 2017 Editor’s Choice Award Winner by HomeWarrantyReviews.com

- 3.5 Star Rating on Consumer Affairs

- 4 Star Rating from Trustpilot Independent Reviews

- B+ Rated on BBB.org

Accreditation and Membership

FAHW has a B+ grade by BBB (Better Business Bureau) accreditation on the list for 20 years now, ever since 5/29/2000.

However, that’s not all.

FAHW is also a proud member of the National Home Service Contract Association, a non-profit trade organization.

With all the positive ratings and accreditations, FAHW holds a very reputable and recognizable status on the market.

Contents table:

- Stand out Features and Services

- First American Home Warranty Breakdown

- First American Home Warranty Pricing and Plans options

- First American Home Warranty Details

– Coverage Specifics

– How to submit a service request

– Limitations

– Add-ons

– Customer service support - Pros and Cons

- Reputation and Customer Reviews

- Alternatives

- First American Home Warranty vs Total Protect Home Warranty

- First American Home Warranty vs Select Home Warranty

- Summary

- FAQs

Stand out Features and Services

- The very highlight of their warranty purpose and items repair agreement is to fix/replace

– improper installation,

– maintenance,

– or modification of appliances. - FAHW home warranty coverage replaces all damaged home systems components and items that can’t be repaired.

This last one is my favorite one.

Don’t you agree with me? 🙂

First American Home Warranty Breakdown

| Feature/Benefit | Details |

| Coverage Area | FAHW covers an area of up to 34 states + the District of Columbia. |

| Annual Cost | Service costs vary from state to state. The average annual cost range is from $300 – $500+ ( the price depends on the plan and options selected ). |

| Service Fees | It depends on your ZIP code. However, the price range is between $75 – $100. ( fee per item service ) |

| Wait period to start coverage | The usual waiting coverage period is 30 days. |

| Deductible | With each claim on your home insurance, you pay a deductible fee of $500 – $1000. |

| Repair Facilities | FAHW works on the principle of call and tell. In other words, you report what home repairs await, and they have a local service provider sent to your home. |

| Turnaround Claim process time | You can file warranty claims ASAP – 24/7.

Note: This depends (mainly) on:

|

| Repair guarantee | There is no repair guarantee. |

| Customer Service availability | FAHW customer support is available 24/7, 365 days.

|

| BBB accreditation | FAHW has a B+ accreditation. |

| Renewal Policy | Plans and other services are renewable. |

| Cancellation Policy | You can cancel your warranty within seven days of the contracts’ start date ( usually 30 days after the purchase ).

Afterward, the contract is considered non – cancelable. Note: A written request must be made to take into consideration your cancellation. |

| Cancellation Fee | Yes, there’s a cancellation fee. After the approval of your cancellation request, you get a prorated refund + a $50 administrative fee. |

| A home inspection or Maintenance records | FAHW plans require a home inspection to be done by a contractor.

Maintenance records don’t require to be reclaimed from a repair person for coverage. |

First American Home Warranty Pricing and Plans options

What is the cost? What it depends on?

I can’t give you a fixed price just for the mere reason that the costs vary. This is highly dependent on the state you live in and the type of home you own (size, location, ZIP code, etc.).

First American Home Warranty determines one’s price quote individually.

This applies that the prices are quote-based.

It’s important to mention that FAHW offers different prices to homeowners and real estate professionals.

Nonetheless, the available plans start as low as $28 per month.

Based on my research throughout many FAHW home buyers, google reviews, other home warranty reviews and reputable rating sites, I came up with three elaborated pricing plans and their coverage in plain site for you.

Excited? 🙂

Me too! Let’s check them out.

Homeowners Plans

In the homeowner’s plans category there are 3 available cover plans: Basic, Value Plus, and Eagle Premier Plan.

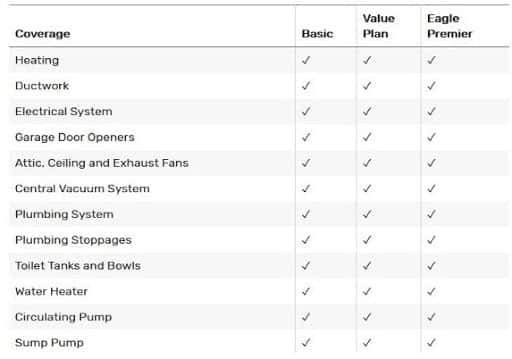

The coverages the table chart presents are optional, and if you want some of them to be included, there is an extra fee to pay.

An important note is the coverage waiting period, which is 30 days, as said previously.

With no further ado, these are the plans available, their coverage, and the extra fee for the optional/add-ons:

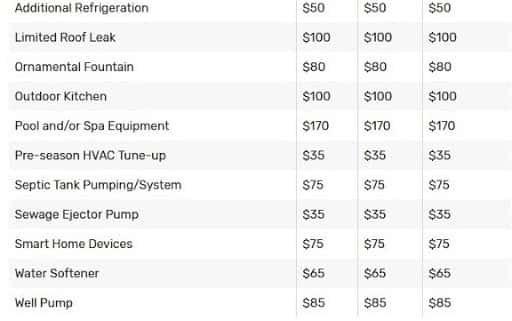

Real Estate Plans

FAHW has great home warranty policies for real estate agencies to get their properties up and running, ready for their new caretaker.

They have the option to choose from 2 available plans:

- Basic coverage

- Optional coverage (First Class Upgrade)

Anyway, let’s go ahead and check what the FAHW real estate plans cover and their additional fee charges for specific add-ons:

There you have it, folks.

In the meantime, let me tell you that the sellers’ cover deal starts once you get your contract number and lasts till the listing wears off (careful: don’t permit for 180 days to be surpassed).

Nonetheless, the sellers’ coverage can negotiate an extension at the company’s discretion and goodwill.

On the contrary, the buyers’ optional coverage includes the following:

- extra refrigeration,

- clothes washer,

- and a dryer.

On the other hand, if you decide to go for an upgrade, these are the extra cover options you get:

- kitchen refrigerator,

- pool/spa equipment,

- septic tank pumping/system,

- and a well pump.

Homeowner Pricing Plans, Add-Ons, and Coverage

I was able to get my hands on some great homeowner pricing plans (samples) from The Balance.

The following pricing plans cover the areas of:

- Alabama

- California

- Kansas

- Florida

- and Maryland

With no further delay, let’s see them:

The prices you see in the table above are sampling calculations on less than 5,000 sq ft single – homes.

Also, these prices reflect the monthly fees (these aren’t total yearly prices).

Important note: All of the homeowner plans come with a $75 service call fee.

To better understand the prices and the options you get, I have this next table to show you.

Let’s check it out:

The First Class Upgrade offers extra coverage for some of the plans’ excluded items, like HVAC (heating, ventilation, and air conditioning) systems.

The upgrade includes:

- clothes washer and dryer,

- trash compactor,

- dishwasher,

- smoke detectors, and more.

Exclusions

- Kitchen Appliances:

Doesn’t cover: Rotisseries, lights, knobs, dials, racks, baskets, rollers, removable trays, removable buckets, door glass, interior lining, lock assemblies, magnetic induction cooktops, meat probe assemblies, and clocks (unless they affect the vital function of the unit).

- Kitchen Refrigerator:

Doesn’t cover: Insulation, racks, shelves, drawers, tracks, handles, lights, ice crushers, beverage dispensers and components, interior thermal shells, food spoilage, stand-alone freezers, refrigerators outside of the kitchen area, and refrigerant recapture, reclaim, and disposal.

- Ductwork:

Doesn’t cover: Grills and registers, improperly sized ductwork, insulation, dampers, and ductwork where asbestos is present.

- Water Heater:

Doesn’t cover: Holding or storage tanks, flues and vents, fuel storage tanks, and solar equipment.

- Electrical:

Doesn’t cover: Doorbells, computer, audio, video, intercom, fixtures, alarm, and components.

- Garage Door Openers:

Doesn’t cover: Remote transmitters, adjustments, doors, gates and gate motors, side rails, hinges, and springs.

- Central Vacuum System:

Doesn’t cover: Hoses and accessories which are removable.

- Clothes Washer and Dryer:

Doesn’t cover: Plastic mini-tubs, soap dispensers, filter and lint screens, knobs and dials, venting, and damage to clothing.

- Ceiling Fans:

Doesn’t cover: Light kits and remote transmitters.

- Plumbing:

Doesn’t cover: Fixtures, faucets, filter, shower head, shower arm, shower enclosure and base pan, caulking and grouting, septic tank, hose bibbs, flow restrictions in freshwater lines, water conditioning equipment, sewage ejectors, saunas or steam rooms, whirlpool jets and fire suppression systems.

- Plumbing Stoppages:

Doesn’t cover: Stoppages caused by foreign objects, roots, collapsed or broken lines outside the foundation, access to drain or sewer lines from roof vent, and costs to locate, access, or install a ground-level cleanout.

- Heating:

Doesn’t cover: Auxiliary space heaters, cable heat, mini-split ductless systems (also heat pump versions), humidifier/dehumidifier systems or accessories, filters (electronic air cleaners too), registers, fuel storage tanks, heat lamps, fireplaces, and key valves, fireplace inserts, baseboard casings and grills, chimneys, flues and vents, underground or outside components and piping for geothermal or water source heat pumps, well pumps and well pump components for geothermal or water source heat pumps, grain, pellet, stove style or wood heating units, electronic, computerized, pneumatic and manual system management and zone controllers, and heat pump refrigerant recapture, reclaim, and disposal.

- Central Air Conditioning:

Doesn’t cover: Mini-split ductless versions, humidifier/dehumidifier systems and accessories, registers, grills, filters (as well as electronic air cleaners), gas air conditioners, window units, underground or outside piping and components for geothermal or water source heat pumps, cooler pads, roof jacks or stands, electronic, computerized, pneumatic and manual system management and zone controllers and refrigerant recapture, reclaim, and disposal.

- Pool/Spa Equipment:

Doesn’t cover: All cleaning equipment, including pop-up heads, turbo, and actuator valves, pool sweeps, liners, lights, structural defects, solar equipment, inaccessible components, humidifier/dehumidifier systems or accessories, jets and components, fuel storage tanks, fill valves, electronic, computerized, pneumatic and manual system management and zone controllers, disposable filtration media, chlorinators, Ozonator, and other water chemistry control equipment and materials, auxiliary, negative edge, waterslide, waterfall, ornamental fountain and pumping, and motor systems or any other pump or motor that does not circulate water from the pool or spa directly into the main filtration system, heat pumps, salt, panel box, remote controls, and dials.

- Additional Refrigeration:

Doesn’t cover: Kitchen refrigerator, insulation, racks, shelves, drawers, tracks, handles, lights, ice makers, ice crushers, beverage dispensers and components, interior thermal shells, food spoilage, and refrigerant recapture, reclaim, and disposal.

- Well Pump:

Doesn’t cover: Well casings, booster pumps, pumps used exclusively for irrigations, animals and non-living quarters, piping or electrical lines, holding, pressure or storage tanks, redrilling of wells, damage due to lack of water, tampering, well pump and well pump components for geothermal or water source heat pumps, improper installation, and access to repair well pump system.

Note: There is a long detailed list with exclusions that you can retrieve from FAHW’s official website.

Extra tip: The First American Home Warranty has coverage available for pest control services, also subterranean termite treatment.

To sum up the entire section

Apart from the above table plans, exclusions, and sample pricing lists, you need to know the following:

- All of the plans include a service fee between $75 – $100.

- First American Home Warranty pays the service contractor for the repair/replacement. BUT, if no contractor can be found and hire one of your choices, you are still entitled to reimbursement by FAHW.

- FAHW doesn’t cover roof leakage.

(The reason why I bring it up it’s because roof leakage can and eventually will happen – especially with older houses). - All of their plans are customizable and based on per quote manner. Nevertheless, you can always add some of the options for some extra money.

- You can always get a free quote on their official website.

- All of their available plans are renewable.

- You can save up to 25% on your 2nd year with FAHW (if you do two years with them from the very start).

- You can get the advantage of their risk-free cancellation policy.

They offer a 30-day cancellation policy on each of the plans.

In addition to this, you can request a cancellation midway under certain conditions.

BUT you will only get an apportioned refund. - FAHW replaces items and systems which are broken beyond repair with brand new ones.

In some cases, they will offer you cash instead. Whereas payments are formed as per FHAW’s negotiating rates with the suppliers, they may be less than the retail price.

First American Home Warranty Details

In this section, I want to emphasize some of the First American Home Warranty details and perks.

For starters, now you know that FAHW is available and covers almost 2/3 of the United States.

They offer a flexible pricing structure and three well-packed plans: Basic, Optional, and Premium Benefits.

Also, coverages that suit: homeowners, buyers, and sellers.

All that within 30 days waiting period.

They are proud carriers of:

- B+ BBB accreditation, based on FAHW BBB reviews,

- 2017 Award-Winning Home Warranty company,

- also, FAHW is a shiny member of the National Home Service Contract Association,

Even though FAHW covers a big portion of damages, the item breaks, appliances, and systems repairments/replacements, unfortunately, there are some it doesn’t cover.

For example, it doesn’t cover:

- mold or bacterial connected problems/damages,

- roof leakage,

- any sort of water damage

Though they do cover repairs of appliances that may get spoiled because of water exposure after some time.

- Some major appliances

- no cover on pre-existing damages,

- no cover on non-essential items of home systems (electric systems).

On the + side, you can always file a claim or submit a home warranty service request.

Their customer support reps are available day or night, 24/7, 365 days a year.

In less than 4 hours of your claim, there will come a local service provider to attend to your problem.

Or, if you wish, you can have someone of your choice fix whatever it’s broken and wait for FAHW to reimburse you.

Bear in mind. The reimbursement will be apportioned.

FAHW will also cover for appliances gone wrong due to inadequate installation, modification, or bad maintenance.

This is something that most home warranty providers don’t offer to their customers.

Limitations

I won’t go into deep on the limitations FAHW’s coverage has, BUT there are some I’ll mention here and the rest are well enlisted on their official website.

Briefly:

- Parts of appliances and systems not vital for the function of an appliance or system aren’t covered.

Like: stove knobs or refrigerator shelves. - If there’s a system failure, the parts of non-vital importance or parts that can easily be moved aren’t covered.

Like: computers, doorbells, televisions, alarm systems. - Damages due to pests, bad maintenance, or wrong handling of an appliance or system aren’t covered either.

- Damages and malfunctions caused by ‘God’s Act’ unfortunately aren’t covered also.

Like: smoke, power surge, theft, riots, vandalism, tree breaking. - Remote controllers, motored gates, springs, hinges, and side rails aren’t covered either.

How to submit a service request

Let’s do this step by step:

- For starters, I’ll suggest you check whether your home warranty covers your damage.

- Secondly, call FAHW’s service number to report the problem, or you can fill in an online form on their website.

- After the report, FAHW will make sure to locate a local service provider to attend ASAP.

The contractor will get in touch with you and you two will work out a mutual agreement on what day to solve the problem. - Once the contractor arrives at your home, you pay them the one-time fee and he begins with home inspection and location of the source problem.

It may be repaired right on the spot if they have the necessary tools/parts. Otherwise, you’ll need a second visit to finish up.

Pros and Cons

PROs

- Budget-Friendly Monthly Premiums.

- 24/7, 365 days availability.

- Cover for bad installation and maintenance of appliances and systems.

- Coverage of at least 35 states.

- Fast claim dispatch in as fast as 4 hours.

- Their warranty replaces unrepairable items and systems.

- Offer termite coverage.

- Unlimited service calls.

- Building permits coverage.

- Online Home Center and Blog.

- 36 years of experience.

- Strong accreditation – B+ by BBB.

- Customizable coverage and price plans.

- Gives a clear list of what’s not covered.

CONs

- No nationwide coverage.

- Charges a fee of $75 – $100 per item.

- Other companies offer more plans to choose from.

- None of the plans offers AC coverage.

- No roof leakage coverage.

- FAHW has more BBB complaints than most other warranty providers.

FAHWs’ disadvantages don’t outweigh their advantages.

In the end, it’s still budget-friendly and in your best interest to become their customer.

Reputation and Customer Reviews

The BBB rated FAHW with three stars out of 5, based on 2,117 customer reviews (BBB doesn’t consider the customer’s reviews in their rating).

I’m sure you read complaints related to FAHW on BBB, but do you know that FAHW closed 3,197 complaints in the last three years?

Even better, they closed 1,342 complaints just in a year.

This is followed by:

- 3.5 Star Rating on ConsumerAffairs.com out of 802 reviews.

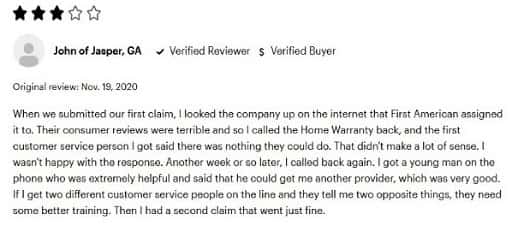

Let’s read through some of First American Home Warranty customer reviews left on Consumer Affairs:

Customer reviews about FAHW left on ConsumerAffairs.com.

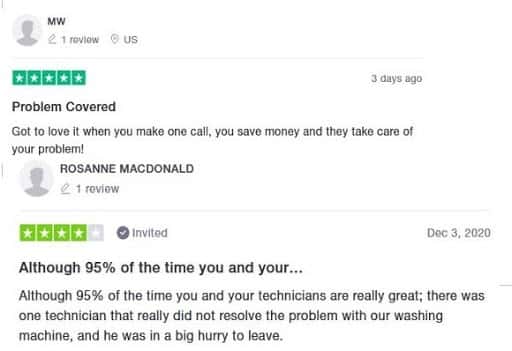

- 4 Star Rating from Trustpilot Independent Reviews. A rating based on 5,635 customer reviews.

Let us read some of them:

FAHW Customer reviews on Trustpilot .com

Other significant ratings from prospective consumer rating sites are:

- 4.6 stars rating on Investopedia.com

- And 4.7 stars rating on Thebalance.com.

First American Home Warranty Alternatives/Competitors

This section will compare what First American Home Warranty offers, covers or don’t, prices, customer availability, and more with two of their competitors.

First American Home Warranty vs Total Protect Home Warranty

Those tiny paragraphs at the bottom of the contracts are crucial, guys.

While we are on the subject, let us first compare both of the company’s warranty plans.

1. Warranty Plans

Total Protect Home Warranty:

This company will reimburse your renovation bill if any appliance or system should stop working for good.

Their coverage plans enable you to customize them based on your financial durability.

The Optimal Plan protects the 20 most often used and vital appliances and home systems. All of Total Protect Home Warranty plans are based on individual needs and coverage.

First American Home Warranty

On the other hand, FAHW’s two coverage plans: the Basic Plan and the Premier Plan, cover only some standard appliances and some other major appliances and home systems.

There is no option of including just that one thing you need in your existing plan. On the contrary, you have to upgrade your cover plan to get what you need.

2. Work Guarantee

Total Protect Home Warranty:

They provide their customers with a written labor warranty of 180 days for all the repair and replacement done by them.

If anything happens to the appliances/systems repaired by them in those 180 days, they will fix them for free or fully replace them (if needed).

First American Home Warranty:

FAHW papers, on the other hand, offer no such thing.

3. Customer Service Support

Total Protect Home Warranty:

The Total Protect contract, as soon as it is signed, is ready to use.

Their customer support is 24/7 available throughout the year (a variety of ways to get in contact with their customer reps).

First American Home Warranty:

Opposite of Total Protect, FAHW’s warranty plans step into effectiveness after 30 days of the activation of plans.

They also offer 24/7 days of customer service at your disposal and are available 365 days a year (via phone, email or online request form).

Final Conclusion

My opinion is that both companies offer similar if not identical home warranties (with some exceptions here and there).

However, there is one tiny detail I haven’t shared with you.

Total Protect Home Warranty has a bit higher service call fees rather than FAHW.

While FAHW has a service fee of $75 – $100, Total Protect’s service fee is $100 – $125.

Nonetheless, this may not make any difference to some of you, and to some, it might be a dealbreaker.

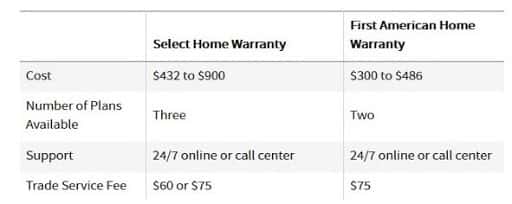

First American Home Warranty vs Select Home Warranty

I want to start off this next outline with a bit of chart comparison on both companies.

This is how it looks:

As you can see from the table, Select Home Warranty starts higher than FAHW and reaches a much higher warranty price.

$414 isn’t a small price bridge to get over.

In return, you get a choice of 3 different homeowners plans for their price, plus they cover roof leaks, and there’s a signup bonus if you pay upfront for a year plan.

On the other hand, FAHW offers a much more competitive price for similar coverage plans.

In contrast to Select Home Warranty, FAHW offers limited coverage on roof leaks (it doesn’t cover roof leakage for new constructions).

Even though Select Home Warranty offers signup bonuses, FAHW policies are much more convenient and budget-friendly.

On the plus side, FAHW definitely has a much broader coverage area.

Final Conclusion

I don’t want to start by stating a winner, but.

You have to love FAHW’s price plans and warranty policies.

Alongside the 24/7, 365 days of customer service available, the (almost) nationwide coverage and plans to choose from – to me, is irresistible.

If you’re so concerned about a constant roof leakage, go ahead and pick another warranty company.

If I were you, I’d stick to this one. Since it makes sense for new construction not to leak – isn’t it new in the first place?

We are all into budget-friendly policies, many add-ons, low service fees, as broad reach as possible. Of course, a whole year of service supports too.

Summary

If you are looking for a low-price but stable and proficient home warranty company, then you’re looking at the right one.

First American Home Warranty company is your best choice.

Yes, they don’t have many plans to choose from, but they offer great add-ons that make up for their exclusions and each of the few plans they own covers your appliances and home systems.

Even better, they have a plan that covers some major systems and appliances.

They’re fast and prompt, with a wide reach, and offer pricing by ZIP code.

Moreover, they let you file a service request in less than 24 hours, and they have a local contractor to your home in less than 4 hours.

My off-the-record advice is for you to pay attention to those tiny sections of your contract.

Secondly, study and go through reviews and cover offers on at least 3 – 4 companies before a final decision.

Anyway, I hope that I did bring up more closely the insight of First American Home Warranty.

Maybe some of you came to realize that FAHW is what they are looking for as a home warranty protector.

FAQ

1.Does First American Home Warranty do business in all states?

A: First American Home Warranty offers coverage in 35 states, including the District of Columbia.

2. How can I reach customer service?

A: You can reach customer service via the company’s toll-free number, via email or submit an online claim 24/7 on their website.

Sign in to request service or review your home warranty coverage details

Service Department: 800.992.3400

3. Does First American Home Warranty have a waiting period?

A: Yes. There is a waiting period of 30 days. You can start making service requests afterwards.

4. Can I cancel my First American Home Warranty?

A: The plans are annual, so it may not be possible to cancel in the middle of a plan.

Nevertheless, you can cancel your plan during the renewal period or call their cancellation support and discuss the interruption in the middle of a contract.

Cancellation support: 800.327.92992 Ext.7521