Are you struggling with your budget? Not sure where all your money goes? I’m guessing you are on the hunt for something that can ease things and get your finances all settled. You have come to the right place because this is exactly what we will be reviewing in today’s article.

But, first, have you ever heard of the envelope system? I can’t see, but I’m guessing heads are turning to the left and the right 🙂 It doesn’t matter, because you will find out real soon if you stay with us all the way.

Aparat from the envelope system, we will get you more info on a particular application that goes by the name of Goodbudget—a sort of virtual financial manager on the go.

In short, this Goodbudget review will teach you how to manage your monthly expenditures and budget better with this beginner-friendly application. Still, let me give you a proper guide of what else you will encounter along the way.

Contents

- Goodbudget Bio

- Goodbudget Awards

- Goodbudget—Digital Envelope System

- What are the features of Goodbudget?

- Web Features

- Application Features

- Digital Money Management—How Does it Work?

- How Do I Open A Goodbudget Account?

- Goodbudget Pricing and Packages

- Goodbudget Alternatives

- Goodbudget vs. YNAB

- Goodbudget vs. Pocketguard

- Goodbudget vs. Quicken

- Pros and Cons

- Goodbudget Customer Reviews

- Conclusion

- FAQs

Goodbudget Bio

Who are they?

This San Francisco-based synchronization finance software is here to set up some ground rules for your finances in a way that you no longer will have to worry whether there is enough for everything. What started as an experiment back in 2009 by Dayspring Technologies, it’s today’s one of the best budget-tracker apps—all because of its visionary and creative leader, Chi-En Yu.

What is Goodbudget? What does it do?

Goodbudget, as the name would have it, is a budgeting tool that helps you assign and manage your finances. It can be accessed via a web browser or the app stores on your Android or Apple devices.

It is nonetheless advisable to read a couple or more Goodbudget reviews to make an informed choice. Why not start by reading our Goodbudget review first.

Let’s get started, shall we?

Goodbudget Awards

Founded in 2009 (as an experiment), as we already mentioned. However, this experiment surpassed everyone’s expectations.

With no further ado, here are two very prominent and significant awards that speak about Goodbudget as the application it is:

- Numbered in the ‘Top 10 Fast-Growing Personal Finance Software’ in the second quarter of 2021, by SaaSworthy.

- Also, voted in the ‘Top 10 Most Popular Personal Finance Software’ in the same quarter of 2021 by SaaSworthy.

This speaks high enough of its potential and financial managerial stability it offers.

Goodbudget—Digital Envelope System

Goodbudget is an app that works following the digital envelope system method.

What is a ‘digital envelope system’?

Traditionally, the envelope system was used as a budgeting technique where cash was divided into separate envelopes like rent, groceries, date night, eating out, etc.

The digital version, it’s a modern twist to the old envelope tactic where you put money in digital envelopes or categories instead.

With Goodbudget, you can spend and save funds via any device. However, this virtual envelope system doesn’t connect or synchronize with any bank accounts or track transactions.

Thus, you will have to manually log the transaction to compare them with your bank statement. Even this way, it can still spot expenses that may have been left out or forgotten and haven’t been recorded for that case.

Though it is not synced with your bank account, it can be synced with your partner’s phones or whoever you are sharing Goodbudget with. This means that when you deduct money from a category, the person you are sharing the app with will be aware of the amount deducted (where and when).

What are the features of Goodbudget?

Here are Goodbudget’s features:

Web Features

- Record transactions and envelope transfers.

- Usage of various refill styles: refill with rollover, set to a specific amount, or add a specific amount.

- Track bank balances along with envelope balances.

- Support weekly, bi-weekly, monthly, and semi-monthly budgeting.

- Access detailed reports: by expense, or month, vs. budget, by location.

- CSV downloadable transactions.

Application Features

- All of your information is automatically backed up to the Goodbudget website. Hence, you don’t have to worry about losing them because of a malfunctioning app or phone issue.

- Quick Expense tracking optimization.

- Able to check your envelope balance on the go.

- Split transactions.

- Established cash budgeting method.

We will mention the following fantastic and incredibly useful features too:

- Multi-Currency – you can make payments or collect payments in various currencies.

- Bills Management – a unique feature that allows you to add, manage and purchase; moreover, it also acts as a reminder if there are any pending bills.

- Spend Tracker – it follows the patterns you leave (tracks expenses and spending habits).

- Tax Reports – gives you a hand with the preparation of your tax report, and it also calculates your taxes.

- Transaction Filters – whatever transaction made is being monitored, and you can manage the filters in a manner convenient to you.

- Alerts – you will be alerted whenever a deadline is approaching or if there’s a pending task or an upcoming event.

Considering all these features, you can easily create and manage cash control envelopes and tax return envelopes—all these are much needed to keep control of your finances.

Seems like it is the perfect way and time to replace your big family budget planner, spreadsheet, or worksheet with software that synchronizes and tracks.

Digital Money Management—How Does it Work?

Goodbudget is, as you have already heard, an envelope budgeting app that is very easy to use.

Let us show you just how easy it is to get started with it:

Step 1—Create Your Budget

The first thing that you need to do is to create a budget and decide how you would want to save that money or spend it. We would advise you to start by choosing the budget period first. This can be monthly, weekly, twice a month, or after every two weeks.

Step 2—Create Envelopes

Try setting up envelopes by type. For example, spending envelopes are linked to the budget period, while annual envelopes are for infrequent transactions. In contrast, as the name suggests, goal envelopes are for saving money for a significant expenditure such as buying a home, a car, or a vacation.

Furthermore, within each type of envelope, you can create savings and spending categories and then budget dollar amounts for all envelopes.

Step 3—Add Accounts

When with Goodbudget, you are entitled to a virtual account. Even though it is virtual, it does keep track of your real-life bank account. Opposed to what the envelopes track, accounts are designed to track where your money is. This feature varies in use, depending on whether you will be using it via a web browser, an android, or an iPhone. It’s crucial to know that you cannot create a ‘debt account’ when using an Android or an iOS device.

Step 4—Add Income

Now start adding money to your envelopes. Remember that undistributed money will not be recorded until assigned to an envelope. Also, you can use this feature regardless of the device you choose to fulfill this action.

Step 5—Fill Your Envelopes

Goodbudget will use your undistributed funds to fill the envelopes. But you can always tweak it and save changes as needed. In your best interest would be to use a smaller amount than what your undistributed funds have. By doing this, you will be able to save aside a one-month cushion. You can achieve this by earning more than what you spend.

Step 6—Record Expenses

This is the step that helps you to make the most out of your budget. By recording your expenses, you will get an accurate picture of how you spend and save money.

This information is crucial to control your spending and shape the budget and finances the desired way.

How Do I Open A Goodbudget Account?

As already mentioned earlier, Goodbudget helps you create virtual accounts which you can use for tracking real-life bank accounts. Therefore, these accounts track where your money is, and not how much you spend or save. Thus these accounts can be used for digital money management, reconciling bank statements, and preventing overdrafts.

Furthermore, if you use the free version, you can create one account to track your expenditure. On the other hand, the paid subscription allows users to create unlimited accounts for tracking every dime in savings, checkings, and credit card accounts.

For this, you will have to log in to the website or the app and click on the add/edit button in the accounts tab. Then add new accounts or edit existing ones. It’s as simple as it can be.

Goodbudget Pricing and Packages

There are two Goodbudget plans at your disposal. Let us check them out.

Free Forever – it’s more than evident the charges are less than a zero. And this is what it includes:

- Ten regular envelopes

- Ten more envelopes

- One account

- Two devices

- One year of history

- Debt tracking

- Community support service.

The paid plan is called Plus Plan – this subscription costs $7 monthly, or if you are considering going for an entire year, you can subscribe to it for the price of $60. With the Plus Plan, you get the following benefits:

- Unlimited regular envelopes

- Unlimited more envelopes

- Unlimited accounts

- Five devices

- Seven years of history can be stored and accessed

- Debt tracking

- Email support (Plus, members get priority email support).

Goodbudget Alternatives

No matter how good your offers are or how cheap you come, there’s always an alternative or two, or more. This is the case with all of the apps of this kind, budget-friendly personal financial software.

On the other hand, there is nothing wrong with having a backup plan. Let us wait no more and go straight and compare Goodbudget against some of their alternatives/competitors. For the sake of this review, I chose to go with three of the many there are.

Goodbudget vs. YNAB

YNAB is an online envelope budgeting app just like Goodbudget. However, upon comparison, it turns out that Goodbudget takes the lead in terms of cost-efficiency.

For instance, Goodbudget is available in both free and paid versions, while YNAB is not a free app. Similarly, the app lacks a security aspect too. It has no two-factor authentication or bank-grade 256-bit encryption. Another major difference between these two apps is the mere fact that YNAB is more of an app designed for individual finance racking, unlike Goodbudget that enables more than two people to share a joint account.

Goodbudget vs. Pocketguard

Pocketguard, too, is available in both versions—free and paid. The biggest advantage of choosing to go with Pocketguard is the half-price you get to pay (even when) deciding to go for their paid plan. For example, the Goodbudget Plus Paid Plan costs $60 per year, while Pocketguard’s paid plan costs only $34.99 a year (nearly half of what Goodbudget charges a year).

Goodbudget vs. Quicken

Quicken, just as Goodbudget, helps you organize and manage personal budgets. You get real-time notifications whenever you use your card; thus, your budget, spending, and custom alerts are always up to date. Quicken also allows you to pay bills directly from the app, monitoring multiple accounts. Both Goodbudget and Quicken have lots to offer, and they don’t really exceed anyone’s pocket budget. But, Quicken doesn’t offer a free plan like Goodbudget. Compared to Goodbudget’s paid plan, Quicken’s plans range from $34.99 to $89.99.

Pros and Cons

I would be surprised if there are only positive things about anything, not just this specific application 🙂

Let’s take a look at some of the pros and cons of Goodbudget.

Pros

- Safe and secured with bank-grade 256-bit encryption.

- Allows multiple users.

- Provides forum support where you can get feedback from community members.

- Cost-effective budgeting tool.

Cons

- Manual logging of transactions.

- Limited features (with the Free Plan).

- No bank account synchronization.

- Limited customer support (with the Free Plan).

Goodbudget Customer Reviews

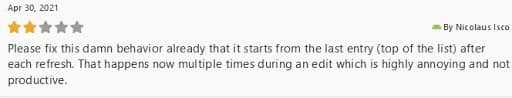

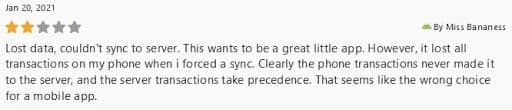

This is one of my favorite parts of any review. The chance to get to read actual, BUT individual experiences of a certain something, and in this case, that’s Goodbudget. Let’s take it away by starting with some.

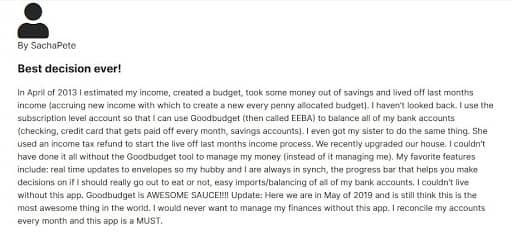

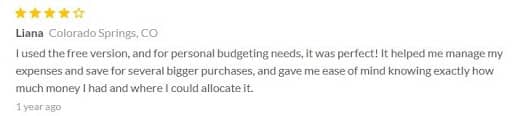

Positive Customer Reviews

(The screenshots are taken by different review websites on budget planner applications)

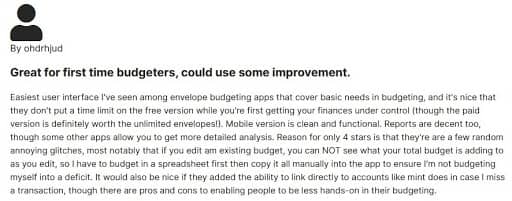

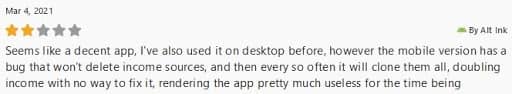

Negative Customer Reviews

(The screenshots are taken by different review websites on budget planner applications)

Conclusion

Goodbudget is a good option for those who wish to manage their spending and savings efficiently in a nutshell. This software is a step up and a great one, moving away from the pen and paper onto your desktops or portable devices. If you are not satisfied with the features included in the Free Plan, you have at least a Plus Paid Plan, which does not come at a rocket-sky high price.

However, you should read multiple Goodbudget reviews before making a final decision and select this digital envelope system in particular.

FAQ

1. Does Goodbudget offer refunds?

Yes. This digital envelope system comes with a thirty-day money-back guarantee. Make sure you cancel your subscription before the thirty days expire. Otherwise, you won’t be able to take a refund. All you need to do is to send an email to [email protected].

2. Can I track debt accounts in my Goodbudget app?

Yes, you can easily view your debt accounts in the Goodbudget app and can track progress on the go—from anywhere at any time.

3. How do I group my envelopes?

It is very straightforward. For example, when you name the envelopes, use a colon (:). For example, Food: groceries. Thus, your spending and budget allocation by envelope reports will be grouped. This way, you will see whether you are on track in each envelope and how you are doing with the entire envelope group.

4. How do I change my budget period in Goodbudget?

The budget is primarily the recurrence period that you set your budget to start on. Thus, it is advisable to set the budget period to match the day you receive your income.

You can easily change it on the web by clicking the add/edit button in the envelopes tab option. For instance, if you’re on your iPhone, just go to the envelopes tab option and then click on ‘edit’ in the left corner. Afterward, click the budget bar at the bottom to choose your budget period and starting date. And finally, save your changes.