Is your credit score low, but you badly need a loan? Stay calm. You’re reading the perfect article right now. Let me introduce you to the solution to your problems: Kabbage.

In this Kabbage Review, I’m going to provide information about:

- Kabbage Bio and History

- Accreditation and ratings

- Kabbage Borrower Terms and Requirements

- Pricing and Repayment

- How to apply for a business loan with Kabbage?

- Customer Service and Technical Support

- Competitors

- Kabbage Customer Reviews

– Negative Reviews and Complaints

– Positive Reviews and Testimonials - Pros and Cons

- Conclusion

- FAQs

Let’s start with some basic information about Kabbage.

Kabbage Bio and History

Who are they? Who’s behind it?

Kabbage is an online financial support company founded in 2008 with a seat in Atlanta, Georgia, USA.

The founders: Rob Frohwein, Kathryn Petralia, and Marc Gorlin created it to help out small businesses financially directly through an automated online platform.

What do they do?

Company focuses on loan offers of up to $250,000 to small businesses. The offers come in the form of short-term credit limits, with a chance to pay them back in 6, 12, or 18 months.

How do they do it? Who is Kabbage Best For?

Kabbage makes things happen through a simple process of automated application, with easy and flexible requirements. They are the best solution for low credit score business owners in need of fast funding.

With no further ado, let’s see what more we can learn from this Kabbage review.

Kabbage Borrower Requirements and Terms

Below is a complete list of all the requirements and terms borrowers should be aware of:

| Feature | Data |

| Minimum time in business | At least 12 months |

| Credit score required | Minimum of 560 |

| Annual revenue required | Revenue of $50,000 per year or

$4,200 per month over the last 3 months |

| Borrowing amounts range | Up to 250.000 |

| Borrowing fee | Between 1.25 – 10% |

| Origination fee | 0% – 4% origination fee (term loan) $20 monthly maintenance fee (line of credit) |

| Funding time | 0-3 days |

| Location requirements | USA |

| Bankruptcies | No active bankruptcies allowed |

| Eligible industries | Most industries with a few exclusions (banks, life insurance companies, finance companies, factoring companies, investment companies, bail bond companies) |

| Personal loan guarantee required | Yes |

| Collateral | None |

| APR | Between 24 – 99% |

Pricing and Repayment

How does Kabbage form their pricing?

What is the repayment process?

What is the monthly fee for a Kabbage loan?

Let’s find out:

Since Kabbage’s credit line APR (annual percentage rate) is between 24% and 99%, this means you pay a fee of 1-10% a month of the total amount borrowed.

Is there a professional service fee?

The answer is no. There are no extra fees, such as:

- an origination fee,

- draw fee,

- document fee,

- subscription or activity fee,

- not even a prepayment penalty on the 6th and 12th-month loan terms.

FinallyKabbage offers different transaction rates for card payments that are processed through invoicing from January 1, 2021. Let’s compare the previous rates with the new ones:

– Until December 31, 2020 – 2.25% per transaction

– From January 1, 20201 – 2.9% plus $0.25 per transaction

Third-party partners can add 1.5% to the maximum rate. Clients who take a six-month loan period will have to pay back a sixth of the total loan amount. For a 12-month loan period, clients will have to pay back a twelfth of the total amount.

Something you’ll love in particular is the ‘no prepayment penalties’ when rolling with Kabbage. This allows their clients to pay their loans early and save some money on monthly or origination fees.

- Clients will be charged late payment penalty fees for six and 12-month term loans. You will receive a four-day grace period after the payment is due. Otherwise, the following amounts will be charged:

1. Less than $100 outstanding — $10 late payment penalty fee

2. Between $100-$5,000 outstanding — $35 late payment penalty fee

3. Higher than $5,000 outstanding — $100 late payment penalty fee

In the course of my research, I found in some Kabbage PPP reviews that as part of the COVID-19 pandemic relief strategies, Kabbage has joined hands with SBA (Small Business Administration) to help small businesses with emergency cash loans.

How to apply for a business loan?

Kabbage loan application will take more or less 10 minutes of your time…

Applying for a loan can take you less than 10 minutes. You can fill out the applications online, and as a bonus – they are completely free. You can even try the Smart box software before applying to get an estimate of the rates and fees.

Anyway, no worries, here is a step-by-step guide to the process:

Step 1:

Go to the following address https://www.kabbage.com/products/ to create an account by providing your email address and a secure password.

Visit (provide their official site) to create an account.

To open an account, all you need is a valid email address and a secure password.

There are other ways too:

- give them a ring at 888-986-8263

- or email them at [email protected].

Step 2:

Enter basic information:

– Personal details (Social security number, contact details, etc.)

– Business details (tax ID, industry, etc.)

– Bank statements from the last three months

– Basic details on invoices

Step 3:

Connect your bank information for Kabbage to assess your business without all the paperwork.

Step 4:

Connect additional business services like PayPal, Xero, Amazon, Stripe, eBay, and Quickbooks so that Kabbage can have an in-depth view of your information.

Step 5:

Provide additional information that Kabbage might request to increase your loan amount.

Step 6:

The application amount is approved.

Step 7:

Funds are sent to the account of your choice. You can request a Kabbage card for easier access to funds.

Kabbage does pull credit score reports to help assess you and your business fairly.

Customer Service and Technical Support

You can go to Kabbage’s help center, and also you can contact them via:

- Phone

888-986-8263.

Support Hours. Mon – Fri, 8am – 9pm EST. Sat-Sun, 10am – 6pm EST. - Email

for support related queries, use [email protected]

and for press related queries use [email protected] - Mailing Address

925B Peachtree Street NE. Suite 1688. Atlanta, GA 30309

Additionally, you can find them on Twitter and Facebook.

Alternatives

It’s never a bad thing to have an alternative to compare your first choice. For that fact, I found not one but three Kabbage alternatives:

- BlueVine

- OnDeck and

- Fundera

Kabbage vs. BlueVine

Both Kabbage and BlueVine provide business lines of credit. Additionally, they offer $250.000 with APRs, which start at 18% and 6- or 12-month terms. Let me start by exposing their differences first. Though they serve the same purpose, their major difference lies in the loan requirements:

- BlueVine requires a minimum of 6 months in business with annual revenue of $100.000

- Kabbage requires one year in business with annual revenue of $50.000.+ Except for Kabbage’s offer of an 18-month repayment term. (another difference)

Kabbage vs. OnDeck

The funding Kabbage and OnDeck offer are the same – business lines of credit. What is different between these companies is that Kabbage:

– larger lines of credit and

– longer repayment terms

On the other hand, OnDeck offers short-term loans, as well as:

– bigger loans

– a chance to repay them over a longer period.

Kabbage vs. Fundera

From the very start, straight into different directions – yet the same purpose.

Kabbage is a lending company, while Fundera acts as a financial mediator/a loan broker. Kabbage provides quick funding for small businesses, whereas Fundera is a loan broker which connects businesses with different borrowers according to their interests and qualifications.

Choosing the right company depends mainly on your needs and qualifications. The most important thing is that you have many to choose from, so take your pick.

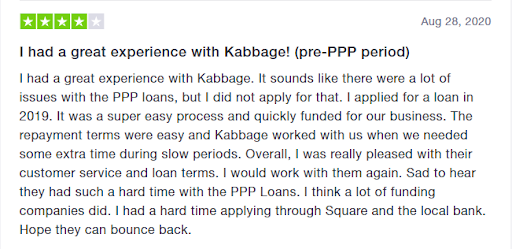

Kabbage customer reviews

An A+ rating accreditation by the one and only BBB (Better Business Bureau) supports and verifies Kabbage’s efficiency and validity ever since 2014.

Kabbage has a rating of 4.2/5 stars on Trustpilot based on over 6,600 reviews and a few testimonials on its website.

Companies of this range, like Kabbage, get a lot of customer reviews. Let’s go through some of the customer’s individual experiences with Kabbage offers and services.

Negative Reviews and Complaints

- Refusal

Kabbage can’t provide services to all who apply, even if you qualify. This can be because of additional information along the process. - Expensive fees

Fees have an APR between 24% and 99%, so people have complained about Kabbage being too pricey. - Front-load fees

Kabbage’s fees have to be paid early in the repayment term, making it difficult for borrowers because sometimes (although there isn’t a prepayment penalty) they can’t save enough money if they repay early. - Sudden/Unforeseen loan limit cut

Kabbage keeps track of all the businesses they lend to. This is a good way for them to see how reliable and stable you are. If anything goes south – they might reduce the borrowing limit or even cut you off altogether.

Positive Reviews and Testimonials

There are many reasons why Kabbage is a great and reliable financial lender. So, here are my top reasons for it:

- Quick and easy application process

Many people like how easy it is to apply for funding from Kabbage. Your application is reviewed in a couple of minutes, and once approved, you can get funded immediately. - Quick access to funds

You can have access to your money whenever you need it. - Efficient customer service

People enjoyed working with Kabbage representatives.

In these Kabbage small business loan reviews, I have found that the negative reviews and complaints are fewer than the positive reviews. People like the financial safety net, which is provided by the line of the credit structure.

Pros and Cons

Let’s check out some of Kabbage’s pros and cons:

Pros:

- Lower borrower qualifications than banks

- No credit score requirements

- No extra fees

- Fast and easy application process

- Clear and informative website advertising

- Available to business owners declared personal bankruptcy (once, as long as one year has passed since discharge)

Cons:

- Limited availability

- Pricey rates

- No long-term financing options

Conclusion

To wrap up, Kabbage is your ideal, quick, and efficient financial solution. It is a bit pricey to some but still a life-saver for small business owners with 0 chances of a bank loan.

While Kabbage doesn’t have a prepayment penalty, some people don’t like that the loans are front-loaded because it makes it more difficult to save enough money for the payment.

My conclusion on all the above is that if you’re in a bad situation and have no one to help you – go for Kabbage. This is the fastest way for you to get up and keep your business running.

I wish you good luck. If I were you, I wouldn’t wait a minute longer, and my next stop will be their website.

FAQ

- What is the customer service availability?

Office support hours are Monday to Friday 8 a.m.-12 a.m. (EST) and Saturdays to Sundays 10 a.m – 6 p.m. You can phone the customer support team at 888-986-8263 or email [email protected]. Kabbage will respond within one business day.

2. Does Kabbage report to credit bureaus?

Kabbage doesn’t report its repayment terms to business credit bureaus or personal credit bureaus.

3. Is Kabbage safe?

Yes, your information will be safe because of the high encryption standards which Kabbage provides.

4. What are Kabbage interest rates?

The average interest rate for a Kabbage loan is about a 40% APR. Their line of credit has an APR ranging from 24% to 99%.