Whether you’re managing accounts for a nonprofit organization or a church, it’s best to use powerful tools to streamline work and ensure smooth accounts management.

Nothing to worry about since the church management software market is booming. There are plenty of ChMS (church management software) to choose from. The most preferred software programs are Aplos, Quicken, and more.

However, in today’s article, we’ll focus on Aplos. So, stay with us for the entire read, and maybe you won’t need to go through more Aplos reviews because this one will cover and elaborate everything from the key features of the software to its pricing and alternatives.

Unlike several other Aplos software reviews, this one is unbiased and transparent. Read on to learn about the Aplos accounting software in detail.

Table of Contents:

- Aplos Overview and Highlights

- Top Features

- Aplos Pricing and Plans

- How does Aplos work?

- Pros and Cons

- Aplos Alternatives

- Aplos vs. eCatholic

- Aplos vs. ChurchTrac

- Aplos vs. Breeze

- Customer Reviews and Ratings

- Conclusion

- FAQs

Aplos Overview and Highlights

What is Aplos?

It is a cloud-based software as a service designed exclusively to satisfy the needs of nonprofit organizations, religious corporations, and churches.

Back in 2009, Tim Goetz decided it was time to end the everyday struggle of churches and nonprofits regarding finances and accounting. So, this is how that idea came to take shape into Aplos church accounting software. Software specially created to simplify day-to-day tasks for nonprofits such as online donations and track giving.

Furthermore, Aplos provides users with robust yet user-friendly tools that when combined, ensure your organization/church achieves better administration and efficiency.

Who is it best for?

This software is best for churches and nonprofits that need help with fund accounting. It takes the stress for them, by tracking donations, excellent budgeting features, and nonprofit solid reporting services. Ultimately, Aplos is a multi-fund-friendly solution that allows users to view and track their financial data and transactions at high and granular levels.

Each section of the Aplos accounting software is set to function as if with a non-accountant in mind. In other words, it can be used by anyone, even those that have no accounting experience at all.

How big is the network?

Aplos has become a rapidly growing network with more than 40.000 nonprofit organizations and religious corporations—who use it daily to manage their accounts and focus better on their missions.

How secure is it?

One thing’s for sure, and you will come across it in almost all Aplos software reviews: the security this software has to offer has the highest of scores, and everyone very much appreciates it.

Therefore, rest assured, your company’s information will remain secure and confidential with Aplos.

Here’s a list of the security measures Aplos accounting undertakes:

- Secure Data Storage and Backups (AWS for data storing, Automatic Backup, implementation of Disaster recovery protocols)

- PCI-Compliant Processing of Payments

- TLS Encryption

- Firewall Protection (Multi-Level)

- Frequent Monitoring

- Internal Controls (Access Control, Monitor your users’ activity logs, Give/Take permissions, Information Lockdown)

- Privacy Safeguards

Are there any Integration Tools?

Yes, Aplos has integrated and partnered with a couple of applications. Check them out:

- Gusto, to process pastoral payrolls, tax payments, and housing allowances easily. The software automatically tracks each pay run in the system, improving the records’ accuracy and saving time.

- PEX, use it to control and manage the expenses of your employee spending.

- Church Multiplication Network, connect with them, and let them assist you with the planting of your church.

- Bloomerang helps you with the management of donations through their complete CRM platform.

- Church Community Builder, integrate with this complete church management software and ensure you’re ahead of things (online giving, volunteer management, event planning, and managing, etc).

- Donor ELF, connect with this personal assistant and stay in touch and up to speed with your church partners.

What kind of deployments does it support? What are the devices supported?

Aplos supports web-based, cloud, and SaaS deployments. It is a web-based software that can be used easily on any device and provides remote sharing access to team members located anywhere. It also supports Mac and Windows operating systems.

Availability of Customer Support?

In terms of customer support, the Aplos accounting software program team gives you the power and flexibility to learn about the software in detail.

They have plenty of material on their website that prospects and customers can use to get all the details regarding the software and customize it to their needs. From resources to articles, webinars, demos, tutorials, training, and live support – customers and prospects can access all.

On the plus side, if anything, you can always contact them through

- Live Chat

- Give them a ring at 888 274-1316 (Mondays to Fridays, from 6 A.M. to 6 P.M. PST.)

- Write an email at [email protected]

- Submit an Online Web Form

- Or, before you try any of the contact ways above-mentioned, check their Knowledge Base and FAQs section.

What kinds of training are provided?

You are going to love the Aplos Training Center.

Currently, there are live sessions taking place on topics like Church Coaching and Nonprofit Coaching. And if you can’t attend a live session, they have a well-equipped Webinar Library, where you can go through all their sessions. Or, if you are interested in one particular course, you can have a look at the ones offered in the Training Courses section.

Nonetheless, among the top courses which the Aplos experts are offering are the following:

- Managing Accounting

- (Aplos) Fundamentals

- Launch Digital Giving

Aplos Top Features

This church accounting software has loads of features. Thus, it’s a handful to list them all. Therefore, we decided to make things easier and give you quick info on their top services/features.

Here are the top features you can expect and use once you integrate this church fund accounting program into your nonprofit’s or church’s landscape.

- True Fund Accounting

This handy and valuable option enables you to track funds efficiently, like special programs and grants.

- Tag Income and Expenses

This feature lets you categorize transactions; you’ll get more in-depth info on the church’s reports by doing so. However, they only apply to income and expenses.

For instance, even though you know precisely where the whole profits are going, you might want to focus on an income coming from someone, in particular, i.e., track it. Thus, tagging makes the whole process simple and more manageable.

- 990 Reporting

Tax preparation has never been as straightforward as with Aplos. This feature allows you to prepare and file 990 returns online quickly. The system notifies you about its status (whether it was received/accepted on time). Simply put, with Aplos church financial software, you can prepare and file IRS forms 990-EZ and 990-N online— the required annual IRS returns for nonprofits.

- Donor Management

The Aplos donor management has an integrated suite of features that improves donor retention and builds a dynamic donor database based on communication tracking activities and giving history. Moreover, the software also lets you track pledges, and that’s possible because of the nicely organized donor database.

- Customizable Chart of Accounts

This feature allows you to create charts of accounts that seamlessly fit your nonprofit/church structure. This package of features also includes accurate funds tacking, and usage of tags, for easier managing of fundraising campaigns, projects, etc.

- Deep Reporting

Aplos church fund accounting is perfect for doing deep reporting. It can help you harness the power of more than seventy customizable reports to help your church or nonprofit fulfill its mission successfully. This feature goes as far as creating all kinds of standard reports (income statements, budget reports, balance sheets, etc.). One of the best things about it is that it lets you keep the reports in PDF formats or directly export them to Excel and save them as CSV files.

- Complete Church Bookkeeping

The complete church bookkeeping feature has everything that you need to manage finances properly.

This includes tools that assist with

– importing transactions from your bank,

– performing journal entries for fund transfers or payroll imports,

– tracking and paying bills,

– creating invoices and receiving payments online,

– ensure bank reconciliation,

– and tracking 1099s.

Aplos Pricing and Plans

Aplos has three plans to offer, and they all come with different features and pricing. Check out the below table to find out more about the plans, their price, and the features they come packed with:

| Plans | Aplos Suite | Aplos Suite + Text To Give | Aplos Suite + Advanced Accounting |

| Prices (per month) and a discounted price (50% off) | Full Price: $59 Discounted: $29.59 | Full Price: $79 Discounted: $39.50 | Custom-tailored solutions start at $159 per month |

| Features | |||

| Fund Accounting | ✔ | ✔ | ✔ |

| Donation Tracking | ✔ | ✔ | ✔ |

| Budgeting | ✔ | ✔ | ✔ |

| Prepaid Cards by PEX | ✔ | ✔ | ✔ |

| Online Giving Forms | ✔ | ✔ | ✔ |

| Event Registration | ✔ | ✔ | ✔ |

| People CRM | ✔ | ✔ | ✔ |

| Text to Give | ❌ | ✔ | ✔ |

| Tag Layers for Financial Reporting | ❌ | ❌ | ✔ |

| Advanced Budgeting by Fund and Tag | ❌ | ❌ | ✔ |

| Recurring Transactions | ❌ | ❌ | ✔ |

| Fixed Asset Tracking | ❌ | ❌ | ✔ |

| Income and Expense Allocations | ❌ | ❌ | ✔ |

| ACH File Export (NACHA) | ❌ | ❌ | ✔ |

- The promotional discount of 50% is available till June 30th (new customers only). The same is applicable for one year only.

- Currently, there is an Aplos sale. On the same, you can save as much as 75% off six months on any of the three plans they offer (check their site for more information).

- You can also save an additional ten percent with a yearly subscription.

- Free Email and Phone Support

- Live and On-Demand Training

- Customizable Reporting

- Budgeting Tools and Reports

- Donation Tracking and Giving Statements

- Pledge Tracking and Statements

- Event Registration and Tickets

- Integrated Online Giving Tools

- Merchant Account For Secure Payments

- People and Donor CRM Database

- Secure Donor Portal

- Letter and Email Builders

- Website Builder

- Groups and Teams Portal

Does it have any free trial/ free version?

Although it is not free accounting software, you can still try it free of charge for fifteen days. And, they won’t ask for your credit card details while using the trial period.

How does Aplos work?

Aplos is a powerful software if you know how to maximize it to its true potential. To get started, the first thing you need to do is make your account. Let’s do that together, step-by-step:

- Visit their official site, and look for the Aplos ‘Log in’ button in the top right corner of the dashboard.

- By clicking on the ‘login’ button, you’ll be transferred to a new window. You can sign up via your Google account or provide a valid email address, create a strong password, and click on ‘create my account!’

- Now that you have an account with them, you can choose a package.

- Once you choose a package, you can start exploring your dashboard. See the features listed and maximize them to make accounting and budgeting as simple, convenient, and easy as they can be.

- For example, you can import contacts, edit charts of accounts to set your starting balances, create a budget and online donation forms, etc.

Pros and Cons

Now that we know the features and pricing of Aplos accounting software, let’s take a look at the pros and cons:

| PROS | CONS |

| Cloud-based software that allows you to create multiple user accounts. | Lack of customization options. |

| Aplos has a simple, clean, and straightforward layout. | The bank integration doesn’t work. |

| Responsive customer service. | You need to use a third-party application for payroll management. |

| They offer various means of learning about the software and finding your way around it. |

Aplos Alternatives

Yes, Aplos is excellent at what it does, but there are some excellent alternatives to it. We selected three of its best options: eCatholic, ChurchTrac, and Breeze.

Aplos vs. eCatholic

eCatholic provides a total content management system for parishes, dioceses, and ministries. The software program enables customers to create websites and website designs. Although a popular choice among churches, eCatholic can’t be viewed as a direct competitor.

Aplos offers all that eCatholic offers in terms of the website builder and other accounting features for easy, quick, and convenient bookkeeping. Hence, if you’re looking for a software program that offers both the flexibility to build a website for your nonprofit or churches, along with quality support and assistance with accounts management – Aplos is your top choice.

However, if you want to maintain exclusivity and need feature-rich software with a complete focus on web design, eCatholic is a better option.

Aplos vs. ChurchTrac

When compared to Aplos, ChurchTrac is much cheaper. ChurchTrac is a great alternative church bookkeeping software program for those starting and tight on a budget. Their pricing starts at $5 per feature a month, which is very cheap compared to Aplos’s basic plan that starts at $29.50 (when discounted).

It offers similar features as Aplos but is more affordable. However, all in all, Aplos is more feature-loaded, offering you better value for the money spent.

Aplos vs. Breeze

Promoted as an ideal choice for small and mid-sized churches, Breeze church management software can be a choice for those who think Aplos is pricey.

If we compare the two, Breeze currently has only 8.000 churches joined with them. Aplos has a strong and growing client base of more than 40.000 churches. That’s a huge difference in numbers.

Aplos is higher priced than Breeze, but Aplos has slashed its starting price of $59 of the basic package to $29.50 as part of its discount offers.

Compared to Breeze, which has a flat rate of $50 per month, and only one plan, Aplos is a suitable choice because it offers better features and is now available at a pocket-friendly price. So, if you have a reasonable budget and want a feature-rich accounting software for managing books and donations of the church, or you’re a nonprofit – Aplos may be a clear winner.

Customer Reviews and Ratings

We will round up this Aplos review by checking its online rating on various sites, and of course, the inevitable customer reviews. Let’s look at its ratings first:

| Name of Website | Rating and No. of Customer Reviews |

| SoftwareAdvice. | 4.44-star rating, out of five, and 142 customer reviews |

| Capterra | 4.5-star rating, out of five, and 149 customer reviews |

| G2 | 4.5-star rating, out of five, and just 24 customer reviews |

| FinancesOnline | 4.6-star rating, out of five, and only 14 customer reviews |

Next up, as we said already – verified customer reviews. Let’s see what their customers have to say about them and the services they offer.

Customer Reviews

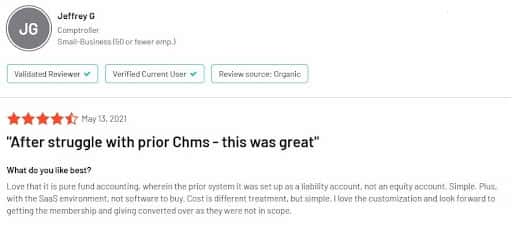

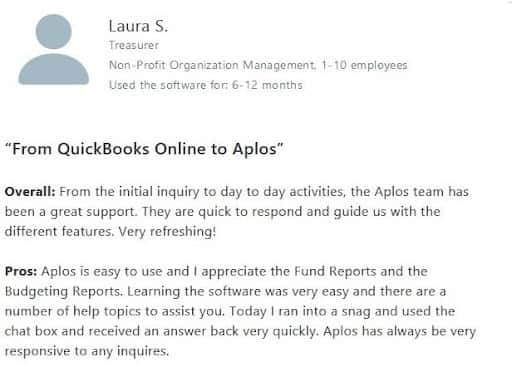

Positive Customer Reviews

(These are verified customer reviews left on G2, Capterra, and SoftwareAdvice.)

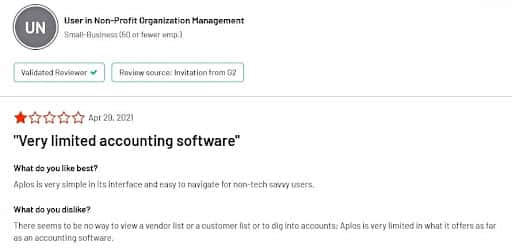

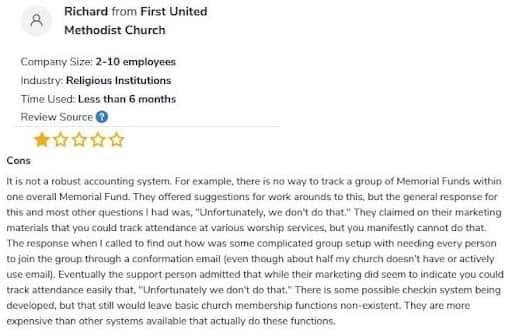

Less Positive Customer Reviews

(These are verified customer reviews left on G2, Capterra, and SoftwareAdvice.)

Conclusion

In a nutshell, Aplos is feature-rich, user-friendly, offers lots of training and online tutoring on how to use the software properly. Moreover, you can get a good bargain if you hurry and take advantage of its discounts and savings, plus, all of the above-mentioned just confirm that this is one of the best church management software programs in the market.

We most certainly hope that this was one of the last Aplos reviews you had to read before visiting their website and subscribing to this church accounting software.

FAQ

1. What is fair market value?

It is predominantly the portion of the ticket that doesn’t impact your taxes, or it is non-deductible for taxes. For instance, tickets, fines, and penalties are regarded as non-deductible for taxes.

2. What is petty cash and how to track it in Aplos?

Petty cash represents a sum of money that can be accessed at any time, and it usually signifies small and insignificant spendings. However, this kind of spendings won’t appear in your bank statements. This is why we suggest you keep separate records of it, to maintain a neat and organized track of expenditures.

You’re in luck because you can keep track of your petty cash via Aplos.

You can create an asset account for your ‘petty cash.’ The same can be done aside, in the ‘chart of accounts’ option, and highlight it as a ‘register.’ Hence, every time you withdraw money from the ‘petty cash account, direct the transaction to the asset account in the register.

3. Can we record a refund?

Yes, you can easily do so. This can be done through the Fund Accounting area; Once you are there, look for the register screen and start entering transactions.

4. How to use QuickBooks for church accounting

When it comes to Aplos vs. QuickBooks for church accounting, Aplos takes the lead as it is designed for that purpose. Although a great accounting software program for small businesses, QuickBooks lacks fund accounting or contribution tracking features. Therefore, for church accounting, Aplos is more practical.

For a more picturesque description of how QuickBooks works for church accounting as opposed to Aplos, check out the image below.

It’s inevitable not to notice how straightforward the Aplos church accounting program is compared with QuickBooks’ multiple stops and work around it. This is mainly due to the system’s complexity, and in the end, QuickBooks isn’t structured to work for churches. Instead, it is ideal for small businesses.

![Aplos Reviews [2023] - Features, Pricing, Alternatives, Pros, and Cons 1 Aplos Review](https://16best.net/wp-content/uploads/2021/07/Webp.net-compress-image-6.jpg)